These activities are also considered to be cost drivers, and they are the measures used as the basis for allocating overhead costs. Cost accounting is a form of managerial accounting that aims to capture a company’s total cost of production by assessing the variable costs of each step of production as well as fixed costs, such as a lease expense. (3) This provision does not restrict the authority of the Federal awarding agency to identify taxes where Federal participation is inappropriate.

- Since incurred cost is an expense for the company, it should be recorded on the debit side of the income statement.

- Costs funded after the six-month period (or a later period agreed to by the cognizant agency) are allowable in the year funded.

- This may require the retailer to record an accrual adjusting entries with an estimated amount (if the electricity bill is not received in time).

The value of the personal property and space may not be charged to the Federal award either as a direct or indirect cost. (1) Fringe benefits in the form of undergraduate and graduate tuition or remission of tuition for individual employees are allowable, provided such benefits are granted in accordance with established non-Federal entity policies, and are distributed to all non-Federal entity activities on an equitable basis. That portion of automobile costs furnished by the non-Federal entity that relates to personal use by employees (including transportation to and from work) is unallowable as fringe benefit or indirect (F&A) costs regardless of whether the cost is reported as taxable income to the employees. (ii) Prescribe guidelines and establish internal procedures to promptly determine on behalf of the Federal Government that a DS–2 adequately discloses the IHE’s cost accounting practices and that the disclosed practices are compliant with applicable CAS and the requirements of this part.

Company

If the newly determined value of a claim is actually higher than the recorded claim, the company will be forced to pay a higher amount than it had planned. The excess claim paid is a loss to the insurer since it exceeds the amount recorded in the books. A policyholder makes a claim for compensation when he/she suffers a loss on the insured loss or event.

(1) The costs of transportation of the employee, members of his or her immediate family and his household, and personal effects to the new location. (2) Reimbursement to the employee is in accordance with an established written policy consistently followed by the employer. (3) The past pattern of such costs, particularly in the years prior to Federal awards. (b) Costs of the non-Federal entity’s subscriptions to business, professional, and technical periodicals are allowable. (a) Costs of the non-Federal entity’s membership in business, technical, and professional organizations are allowable. (3) The non-Federal entity obtains the financing via an arm’s-length transaction (that is, a transaction with an unrelated third party); or claims reimbursement of actual interest cost at a rate available via such a transaction.

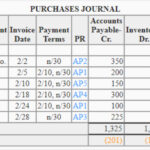

The purchase may be made either through a credit card or a billing arrangement with the seller of the goods. Most companies buy raw materials in bulk from manufacturers and wholesalers on credit, with an agreement to pay at a later date. If a business cannot meet its responsibilities to repay a loan, inevitably the loan defaults. Although this announcement can ease financial burdens, in turn lessen debts and essentially pay off incurred costs, it remains that this is a last resort action. It has a somewhat negative impact on a business applying for more/extra credit. They have been paid to the supplier and the debt is no more, but it remains a debt to the buyer until the amount on the card has been cleared.

(1) Facilities means land and buildings or any portion thereof, equipment individually or collectively, or any other tangible capital asset, wherever located, and whether owned or leased by the non-Federal entity. (c) Gains or losses of any nature arising from the sale or exchange of property other than the property covered in paragraph (a) of this section, e.g., land, must be excluded in computing Federal award costs. (2) The property is given in exchange as part of the purchase price of a similar item and the gain or loss is taken into account in determining the depreciation cost basis of the new item. If the non-Federal entity is instructed by the Federal awarding agency to otherwise dispose of or transfer the equipment the costs of such disposal or transfer are allowable. (a) Costs incurred in accordance with the non-Federal entity’s documented policies for the improvement of working conditions, employer-employee relations, employee health, and employee performance are allowable. (2) If more than one proceeding involves the same alleged misconduct, the costs of all such proceedings are unallowable if any results in one of the dispositions shown in paragraph (b) of this section.

Which Types of Costs Go Into Cost Accounting?

IBS excludes any income that an individual earns outside of duties performed for the IHE. Unless there is prior approval by the Federal awarding agency, charges of a faculty member’s salary to a Federal award must not exceed the proportionate share of the IBS for the period during which the faculty member worked on the award. Product and service costing provides companies with information about the costs of individual products or services. We will sometimes just refer to product and service costing as «product costing», but of course some companies offer physical products while others offer services. We explain how companies design product costing systems and we make you familiar with important methods of product costing.

Standard costing uses standard costs rather than actual costs for cost of goods sold (COGS) and inventory. Activity-based costing takes overhead costs from different departments and pairs them with certain cost objects. Lean accounting replaces traditional costing methods with value-based pricing. Marginal costing evaluates the impact on cost by adding one additional unit into production.

Uses of Incurred Cost

At the core of their cost-accounting system, companies allocate overhead costs to individual products. We show participants how to allocate the costs incurred to the company’s products and introduce them to the most important methods and challenges of product costing. (c) The costs of idle capacity are normal costs of doing business and are a factor in the normal fluctuations of usage or indirect cost rates from period to period.

Trump gets another rally-related bill from Erie. This time for $5,200 — GoErie.com

Trump gets another rally-related bill from Erie. This time for $5,200.

Posted: Mon, 31 Jul 2023 19:05:34 GMT [source]

The gasoline used in the drive is, however, a sunk cost—the customer cannot demand that the gas station or the electronics store compensate them for the mileage. A noteworthy shortcoming of accrual accounting is that it shows a profit even though any cash inflows have not taken place. This results in a reportedly profitable entity when in fact it is ‘starved for cash’. Although the company has yet to receive its billing statement, it is already liable for its communication expense since it has used this resource for the month. (2) Gasoline taxes, motor vehicle fees, and other taxes that are in effect user fees for benefits provided to the Federal Government are allowable. (vii) Any individual related by blood or affinity whose close association with the employee is the equivalent of a family relationship.

Definition of Cost Incurred

The transaction is recorded in accounts payable since it is a cost that the business needs to pay in the future. For example, if Company XYZ purchases goods worth $1,000 on credit, the company will have an incurred expense where does the cost of goods sold go on the income statement of $1,000. Fixed expenses can be used to calculate several key metrics, including a company’s breakeven point and operating leverage. Therefore, the accountant will record them as expenses for the reporting period (March).

- The amount of the gain or loss to be included as a credit or charge to the appropriate asset cost grouping(s) is the difference between the amount realized on the property and the undepreciated basis of the property.

- Finally, we will introduce you to a framework that distinguishes three sub-systems of cost accounting.

- (b) For rates covering a future fiscal year of the non-Federal entity, the unallowable costs will be removed from the indirect (F&A) cost pools and the rates appropriately adjusted.

- (2) Are unallowable because they are not allocable to the Federal award(s), must be adjusted, or a refund must be made, in accordance with the requirements of this section.

- These costs, together with those described in (4), are limited to 8 per cent of the sales price of the employee’s former home.

(ii) An insurer or trustee to maintain a trust fund or reserve for the sole purpose of providing post-retirement benefits to retirees and other beneficiaries. (3) Amounts funded in excess of the actuarially determined amount for a fiscal year may be used as the non-Federal entity contribution in a future period. (iii) Amounts funded by the non-Federal entity in excess of the actuarially determined amount for a fiscal year may be used as the non-Federal entity’s contribution in future periods.

Free Accounting Courses

Every company must determine the price customers will be willing to pay for their product or service, while also being mindful of the cost of bringing that product or service to market. Cost and price are often used interchangeably, however, the two words mean something different when it comes to accounting and financial statements. When conducting financial analysis or making investment decisions, it’s important to understand the difference between cost and price and how they impact a company’s financial profile.

An incurred expense becomes a paid expense once the business has paid the cost it owed the supplier of the goods or services. Most of the time, incurred expenses are paid immediately after they are incurred, while at other times, they may take several years before they are paid. A business uses water over the course of a month, but is not billed for its water usage until the end of the quarter.

Under the accrual basis of accounting, the firm incurred the cost of the water when the water was consumed, so the firm should accrue this cost in its month-end financial statements. All sunk costs are fixed costs in financial accounting, but not all fixed costs are considered to be sunk. A company’s breakeven analysis can be important for decisions on fixed and variable costs. The breakeven analysis also influences the price at which a company chooses to sell its products. A cost incurred is a cost for which a business has become liable, even if it has not yet received an invoice from a supplier as documentation of the cost.

Typical costs charged directly to a Federal award are the compensation of employees who work on that award, their related fringe benefit costs, the costs of materials and other items of expense incurred for the Federal award. If directly related to a specific award, certain costs that otherwise would be treated as indirect costs may also be considered direct costs. Examples include extraordinary utility consumption, the cost of materials supplied from stock or services rendered by specialized facilities, program evaluation costs, or other institutional service operations. Where wide variations exist in the treatment of a given cost item by the non-Federal entity, the reasonableness and equity of such treatments should be fully considered. See the definition of indirect (facilities & administrative (F&A)) costs in § 200.1 of this part. Some nonprofit organizations, because of their size and nature of operations, can be considered to be similar to for-profit entities for purpose of applicability of cost principles.

(c) Any cost allocable to a particular Federal award under the principles provided for in this part may not be charged to other Federal awards to overcome fund deficiencies, to avoid restrictions imposed by Federal statutes, regulations, or terms and conditions of the Federal awards, or for other reasons. However, this prohibition would not preclude the non-Federal entity from shifting costs that are allowable under two or more Federal awards in accordance with existing Federal statutes, regulations, or the terms and conditions of the Federal awards. (e) Be determined in accordance with generally accepted accounting principles (GAAP), except, for state and local governments and Indian tribes only, as otherwise provided for in this part. For instance, say your utility company sends you an invoice for your electrical usage only in the following month, you still have to recognize the power bill as an expense for the current month rather than the next month. This is because you have already used the asset (electricity consumption) in the first month, so you are liable for that usage in the same month and not when you are making the usage payment (the following month). The two opposing forces are always trying to achieve equilibrium, whereby the quantity of goods or services provided matches the market demand and its ability to acquire the goods or service.

This includes, but is not limited to, the non-Federal entity’s contributed portion by reason of cost-sharing agreements or any under-recoveries through negotiation of flat amounts for indirect (F&A) costs. Also, any excess of costs over authorized funding levels transferred from any award or contract to another award or contract is unallowable. All losses are not allowable indirect (F&A) costs and are required to be included in the appropriate indirect cost rate base for allocation of indirect costs. (d) For rates covering the current period, either a rate adjustment or a refund, as described in paragraphs (b) and (c) of this section, must be required by the cognizant agency for indirect costs. The choice of method must be at the discretion of the cognizant agency for indirect costs, based on its judgment as to which method would be most practical.

(8) For a non-Federal entity where the records do not meet the standards described in this section, the Federal Government may require personnel activity reports, including prescribed certifications, or equivalent documentation that support the records as required in this section. (ix) Because practices vary as to the activity constituting a full workload (for IHEs, IBS), records may reflect categories of activities expressed as a percentage distribution of total activities. Charges for work performed on Federal awards by faculty members having only part-time appointments will be determined at a rate not in excess of that regularly paid for part-time assignments. (iv) The salaries, as supplemented, fall within the salary structure and pay ranges established by and documented in writing or otherwise applicable to the non-Federal entity. (iii) The supplementation amount paid is commensurate with the IBS rate of pay and the amount of additional work performed.