The advantage isn’t as huge as others about this number, however, which financial campaign was a good option if you don’t need to see an immediate deposit requirements to earn an excellent cash reward. Rather than very bank incentive offers about this list, the newest Chase Safer Banking bonus doesn’t require lead put. As an alternative, you’ll must satisfy the very least quantity of being qualified deals such while the debit credit purchases and you may Zelle transfers, nevertheless’ll features two months to fulfill the necessity. That it bonus offer enables you to earn a cash extra that have the selection of possibly a new combination examining-and-savings account otherwise a new checking account only.

How much time Can it Get To own Insured Money As Readily available When the A financial Goes wrong?

We believe individuals will be able https://vogueplay.com/ca/betsafe-casino-review/ to make monetary conclusion which have believe. Should your Video game or any other deposit membership is at a card connection, you get the same form of $250,one hundred thousand insurance rates if it is a part of your own National Relationship of Credit Unions (NCUA). The brand new FDIC try another federal company which was created in 1933 to help with stability regarding the financial system. If a lender fails, the new agency pays depositors which have money from the newest Put Insurance rates Money (DIF), to which their member establishments lead. Financial disappointments tend to be less frequent as the FDIC been process inside the 1934. Before you to, a large number of banking companies hit a brick wall inside Higher Despair—4,one hundred thousand within the 1933 by yourself.

Register now for totally free use of the content

Read the strategy facts over to learn all the regulations and you may criteria to earn the fresh savings account bonus, in addition to an excellent steep lowest transfer count which can never be convenient. An informed lender promotions provide the opportunity to earn a critical bucks bonus for joining a new account with no charges otherwise costs that are an easy task to rating waived. An informed bank incentives for you are ones that have conditions you happen to be comfortable with, for instance the period of time you’ll have to keep your money from the membership to earn the bonus.

In the event the Government Set-aside reduces the put aside ratio, it lowers the degree of dollars you to definitely banking companies have to hold in supplies, permitting them to generate much more finance to help you users and you will enterprises. Nevertheless increased using hobby is in addition to try to improve rising prices. Even though just $250,one hundred thousand try insured, you are not going to get rid of 750,000 of so many money deposit. If those money is actually 90% of the deposits then your lender is within deep issues, however nonetheless score 90% of your uninsured cash back. I discovered there’s something titled CDARS enabling a individual open a multi-million dollar certification out of put account that have a single lender, who provides FDIC exposure for your account. That it lender spreads the individual’s money round the several banks, to ensure for each and every financial keeps lower than $250K and certainly will supply the simple FDIC coverage.

Places ballooned away from $62 billion so you can $198 billion over that time, while the 1000s of technology startups parked their money during the lender. Usually, customers are allowed to subscribe borrowing unions considering where it live or performs. When you yourself have a combined account, the newest FDIC talks about each individual to $250,100. You could have both mutual and you will solitary accounts in one lender and get insured per.

Better on the internet financial institutions you to definitely capture bucks dumps

Open an everyday Checking account having the absolute minimum beginning deposit of $25 from the render web page. Even if you got more the newest $250,100000 restrict deposited, you will possibly not get rid of any money. A typical example of this can be seen in the fresh inability out of Very first Republic Financial and its subsequent pick by JP Morgan Chase in-may out of 2023. Or even, government entities will get security the remainder of your finance, because offered to perform following the Trademark Financial and you will Silicone Valley Bank problems. Sooner or later, all buyers property were secure when Flagstar Lender got over Signature Lender, and you will Earliest Residents Lender & Faith Co. took more Silicone Valley Financial. As an alternative, that money try borrowed over to other customers otherwise used to commit.

- •What number of containers recycled from the pilot system thirty day period sets SF BottleBank at the bottom step 1% of the many recycling cleanup stores on the condition.

- Experts just who secure info, such bartenders, server and you will locks stylists, could possibly get apparently must put bucks.

- Listed here are a few of the contrasting is actually contrasts anywhere between him or her percentage tips.

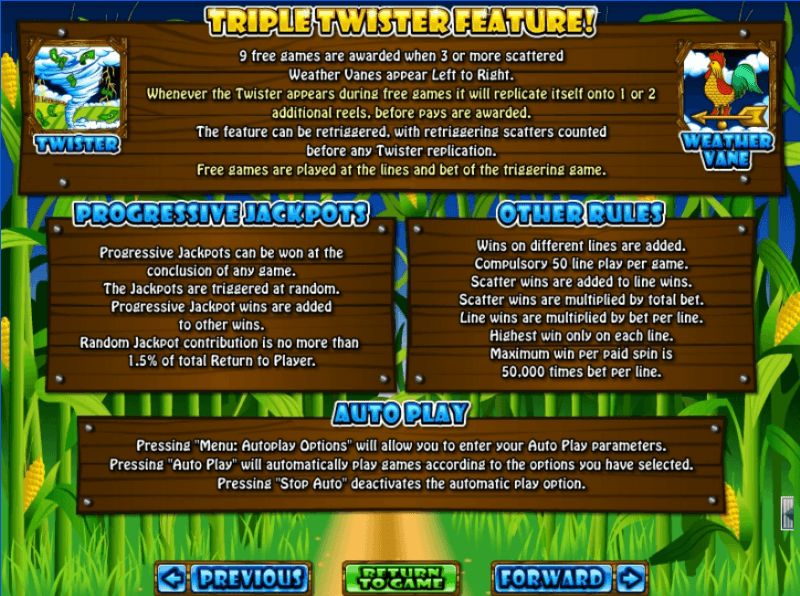

- Microgaming game is search an identical right now, he’s a same formula because of their harbors.

- Searching for the FDIC symbolization during the bank teller window or to your entrances to the financial department.

An arbitrary sampling from associate companies comes with the newest broker divisions out of the big banking institutions, as well as independents for example Edward Jones, PWL Investment and Raymond James and electronic brokers such as Questrade and you can Wealthsimple Investment. One social or sweepstakes gambling establishment from your shortlist also provides an excellent $step 1 greeting added bonus. All of the on-line casino we review comes after so it so we is make sure we offer fair and you can dependable recommendations for all of our professionals. It antique video game out of PlayTech notices your spin the brand new reels having a good cuddly panda buddy and you may up against an attractive bamboo community background. Simply belongings half dozen or maybe more ‘Fortunate Coins’ inside the game to lead to a profitable free revolves round. To make an excellent $step 1 put during the an on-line personal local casino is simple and easy doing.

There had been 21 broker insolvencies while the CIPF is actually designed inside 1969, the most recent being the 2015 dying out of Octagon Investment. Based on the newest annual declaration, the newest fund had $step 1.1-billion accessible to deploy in the an enthusiastic insolvency from mixture of a general financing purchased government securities, credit lines and you can insurance rates. Just as CDIC is actually financed because of the banking institutions, CIPF try financed from the their professionals – funding businesses and common financing traders.

Borrowing Suisse try undone by many people points, however, close to the top of the list are two naughty, brutish and you can short periods of put journey. The fresh Swiss financial scrambled to manage the brand new fallout whenever subscribers withdrew SFr84 billion ($94.step 3 billion) past October. «While i dug higher, they told me that the account is actually flagged to have deceptive interest and they encountered the to intimate my personal membership with no warning and you can rather than explanation,» it extra.

Both checking accounts give consumers entry to more than 100,100 surcharge-free ATMs and need merely $25 to open. OneUnited now offers an automated savings element, which can be used ranging from OneUnited profile otherwise having an outward linked family savings. The newest unit rounds right up per purchase and moves the other changes to a family savings. Customers who’ve an excellent OneUnited family savings is actually instantly enrolled in the financial institution’s very early lead deposit element, BankBlack Early Pay, after acquiring one or two individually deposited paychecks. OneUnited Bank is the very first Black-owned online lender as well as the biggest Black colored-had bank in the U.S.

You to go-off stress one of consumers, who withdrew their money within the signifigant amounts. Whenever rates of interest rise, bond cost fall, and so the diving inside the cost eroded the worth of SVB’s bond profile. The brand new profile is actually yielding an average step 1.79% return a week ago, much underneath the ten-12 months Treasury give of around step 3.9%, Reuters stated.

The united states internet casino to your better $step 1 deposit bonus is actually Hello Many. Below are a few our shortlist observe our very own bullet-upwards of the greatest $1 deposit personal gambling enterprises in the usa. The us internet casino on the low lowest put are Good morning Hundreds of thousands. Boost your bankroll to your greatest $step one put casinos on the internet in america.